Note that there is no time limit to answer the questions, and you can have as many goes at answering each question as you like. Why not try one of our accounting quizzes and test your knowledge of bookkeeping and accounting. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model. Each of these models has its own set of steps that should be followed when deciding. To begin the quiz, simply quick on the “Start Quiz” button below.

What are some common accounting decisions?

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Appropriate records, methodologies and costs claimed will vary between sectors and projects. Revenue doesn’t have a strict line for what is a reasonable methodology; a company will pass the Accounting Test if the allocation method is “bona fide, reasonable, and based on the facts of the individual claim”.

How confident are you in your long term financial plan?

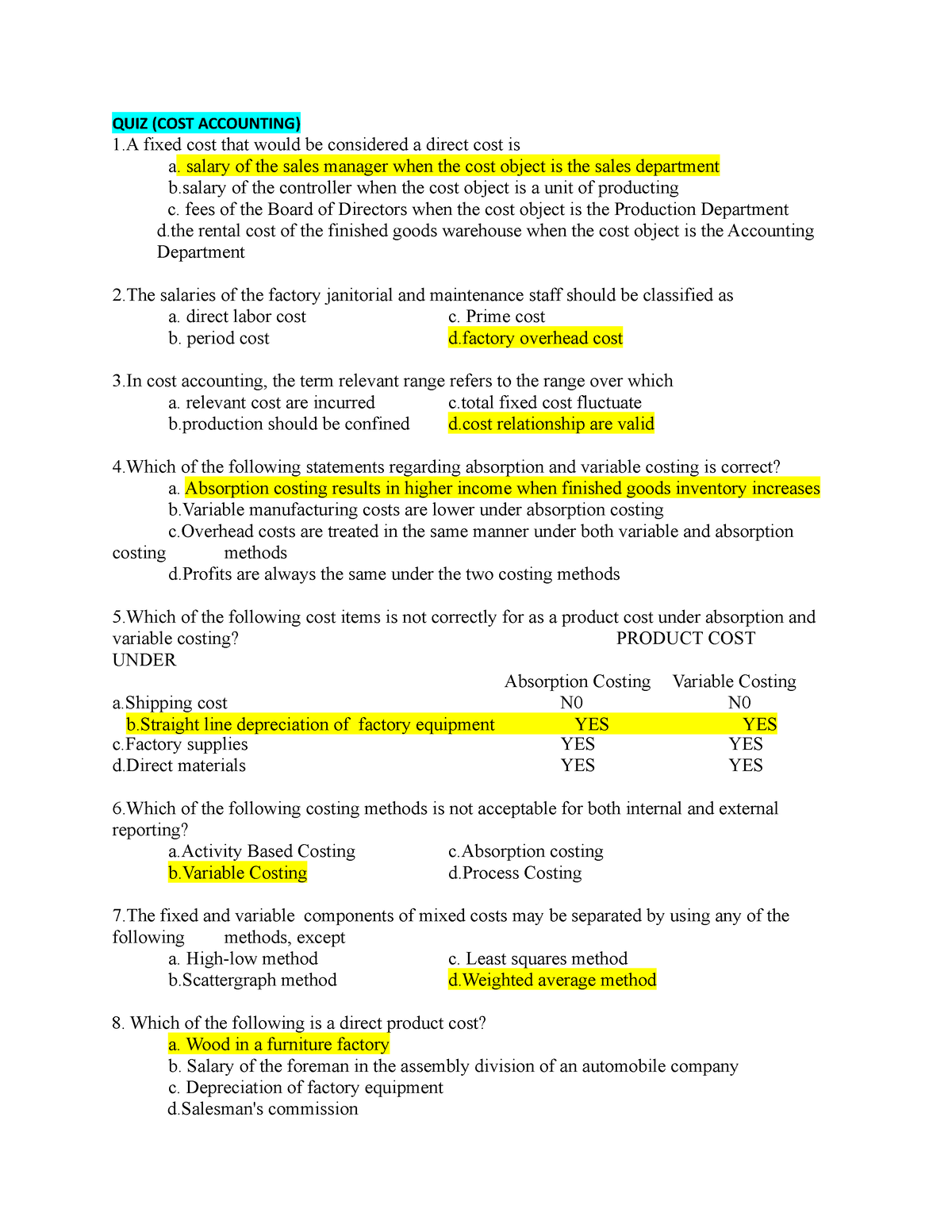

You can use these MCQs to help prepare for your exams, interviews, and professional qualifications. Receive instant access to our entire collection of premium materials, including our 1,800+ test questions. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

R&D Tax Compliance: What is the Science Test?

In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome. Factors that should be considered when making decisions include the company’s financial position, Cash Flow, profitability, and business strategy. Accountants use the information to make decisions by analyzing data and trends to make informed decisions to help the company achieve its goals. When making decisions in accounting, it is essential to consider all relevant factors. Some of the factors that may be considered include the company’s financial position, Cash Flow, profitability, and business strategy.

Though the Accounting Test forms part of an audit from Revenue, it is important to pass this test before making your claim. You won’t know for sure until Revenue investigates your claim (which in itself is not guaranteed), but you should make your claim with the criteria in mind, so you aren’t caught out on the back end. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. If all other sites open fine, then please contact the administrator of this website with the following information. For each item below, write down what is required on a piece of paper.

- Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Alternatively, you may implement monthly check-ins which review last month’s work and what new uncertainties may have arisen.

Financial Statements Outline

You can check your answers later through the link at the end of the quiz.

In the event of an R&D Aspect Query from Revenue, companies need to prove that they meet the Science Test and the Accounting Test. The former ensures that your R&D activities qualify under Revenue’s definition and the latter is to confirm that the costs have been correctly claimed. Both tests form part of an enquiry into an R&D tax claim and are conducted by Revenue’s experts. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. This multiple choice question (MCQ) test covers the topic of introduction to accounting.

It may also include a review of the methodologies in place for identifying qualifying costs and the calculations used to apportion expenditure. If we are to see more emphasis on compliance, claimants need to pre-emptively confirm that they pass both tests. Though they are officially part of Revenue’s beer is proof examination into an R&D tax claim, they are a great way to confirm a project’s eligibility before making a claim. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. We faced problems while connecting to the server or receiving data from the server. The records should be contemporaneous (i.e., not filled in later) and reliable.